Category: Financial Wellness

September 19, 2024 •

How to Save Taxes While Making an Impact

September 17, 2024 •

7 Questions to Help Optimize Your 401(k) Plan

August 26, 2024 •

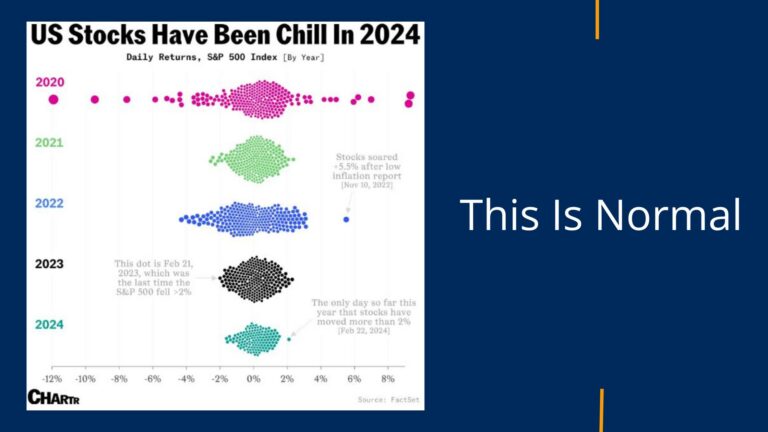

This Is Normal

June 17, 2024 •

Q2 2024 Plan Sponsor Newsletter

No results found.