Lessons from a Banner Year: How 2024 Shaped the Investment Landscape

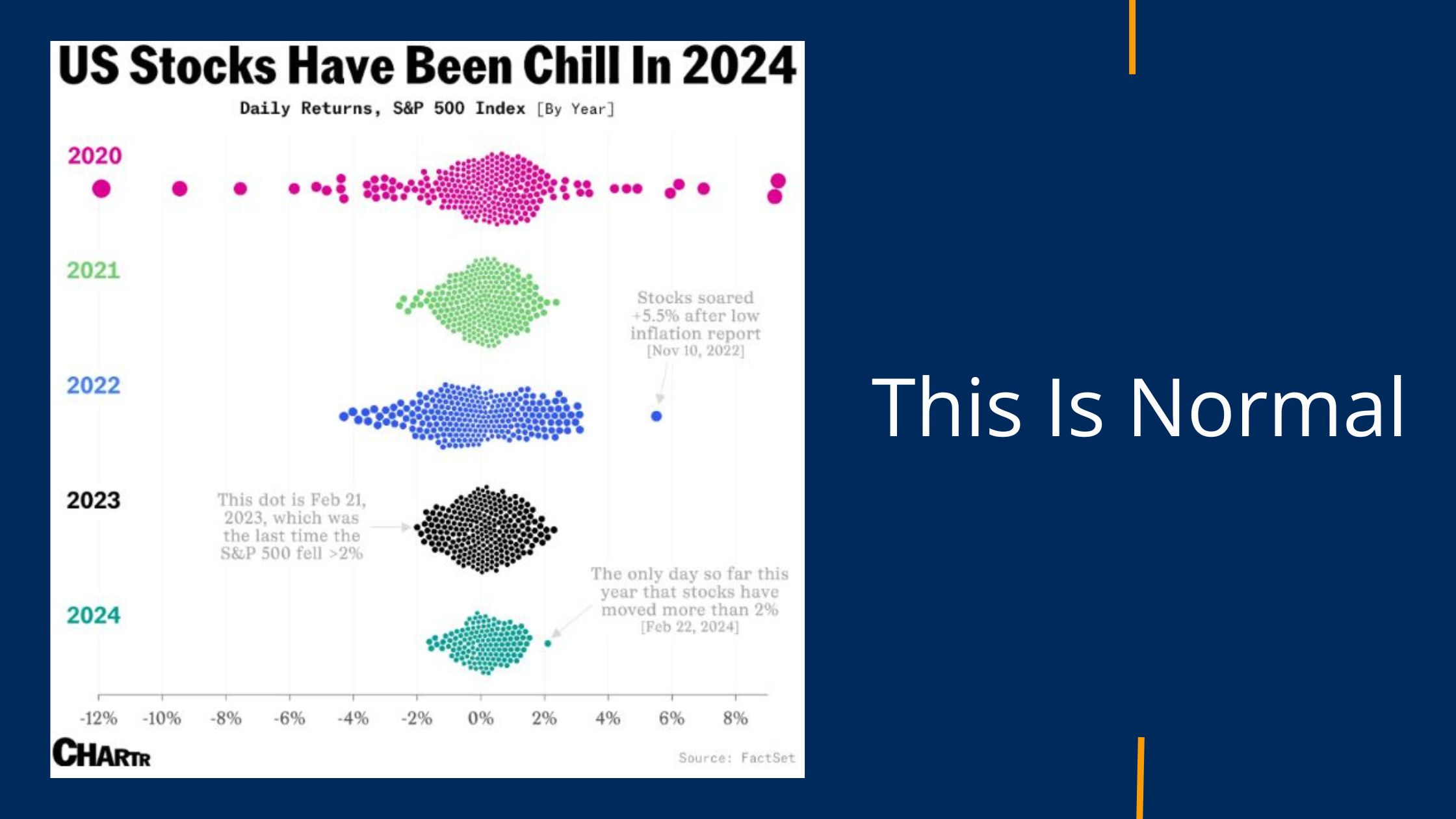

In this episode, Jason takes a deep dive into the key financial events of 2024. From understanding the S&P 500's stellar 25% performance to exploring the nuances of inflation, unemployment, and GDP growth, Jason provides a comprehensive reflection on a remarkable year for both the stock market and the economy. He also tackles pressing questions about investment strategies, including the role of diversification, the pitfalls of over-relying on dividends, and how to align your portfolio with your long-term goals. If you're wondering how to stay grounded in the face of market unpredictability, this episode is for you. Tune into…