Category: Investments

October 18, 2024 •

Election Concerns and Investing… Mix at Your Own Risk

August 26, 2024 •

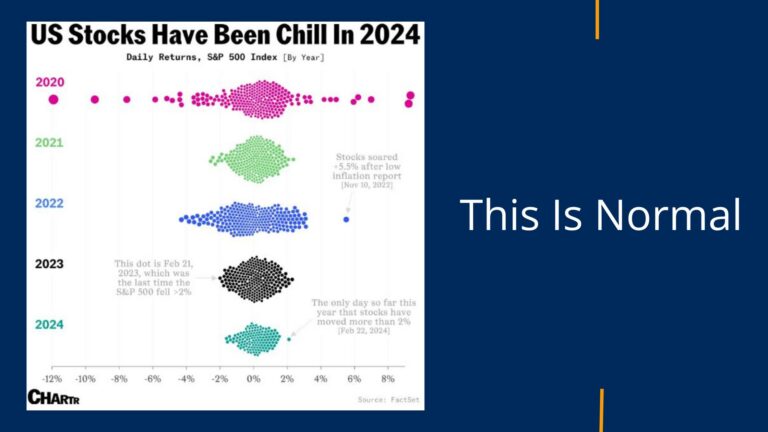

This Is Normal

January 25, 2024 •

Bitcoin ETF, Where Does It Fit Into Your Investments?

December 29, 2023 •

Should You Invest in AI Stocks?

November 1, 2023 •

What To Do With Those Old 401(k)s

No results found.