Navigating Election Uncertainty: How to Protect Your Investments and Avoid Panic

With another election on the horizon, it’s no surprise that many of our clients are feeling nervous. The constant stream of headlines predicting market doom or dramatic economic shifts depending on who wins can leave even the most seasoned investors questioning their strategy. But while concerns about political change are understandable, it’s important to remember that markets—and disciplined investors—have navigated turbulent times before.

Understanding Election-Year Anxiety

A common fear among investors is that a change in leadership could trigger a financial crisis, or worse, send the economy into a tailspin. Whether it’s concerns over new policies, rising taxes, or market instability, these uncertainties can lead to emotional decisions that might derail a carefully crafted investment strategy.

However, it’s essential to keep these fears in perspective. While it’s true that elections can bring some short-term volatility to the markets, history shows their long term effect is minimal (see graphic below). The truth is, there are always unpredictable events that could disrupt the markets, from political shifts to unexpected global crises. These “tail risks,” or rare, extreme events, are impossible to predict but are generally unlikely to occur.

Instead of focusing on what could happen, it’s more productive to acknowledge that the world will likely keep moving forward, and so will the economy. Investors who remain disciplined are typically rewarded for staying the course.

The Role of Media in Investor Anxiety

Another factor that often amplifies investor fears during election seasons is the media. With 24-hour news cycles and constant coverage of political developments, it’s easy to get caught up in worst-case scenarios. Media outlets thrive on keeping viewers engaged, often by highlighting the most dramatic or concerning aspects of current events. “If it bleeds, it leads” has never been truer than it is today.

While staying informed is important, it’s equally crucial to be mindful of how much media you consume. Constant exposure to negative news can increase anxiety and make you feel like you need to take immediate action to protect your finances—even when that’s not necessary. It’s important to remember that what you see on the news is the product of organizations that profit from your fear and subsequent consumption of their content, so they’ll say whatever they need to in order to keep you watching, listening, or clicking.

The Market Has Seen It All

One reassuring fact for investors is that the market has experienced countless political changes, economic cycles, and global crises—and has continued to grow over the long term. Whether the party in power is making policy changes, or global events are causing short-term disruptions, the market has a history of adapting and recovering.

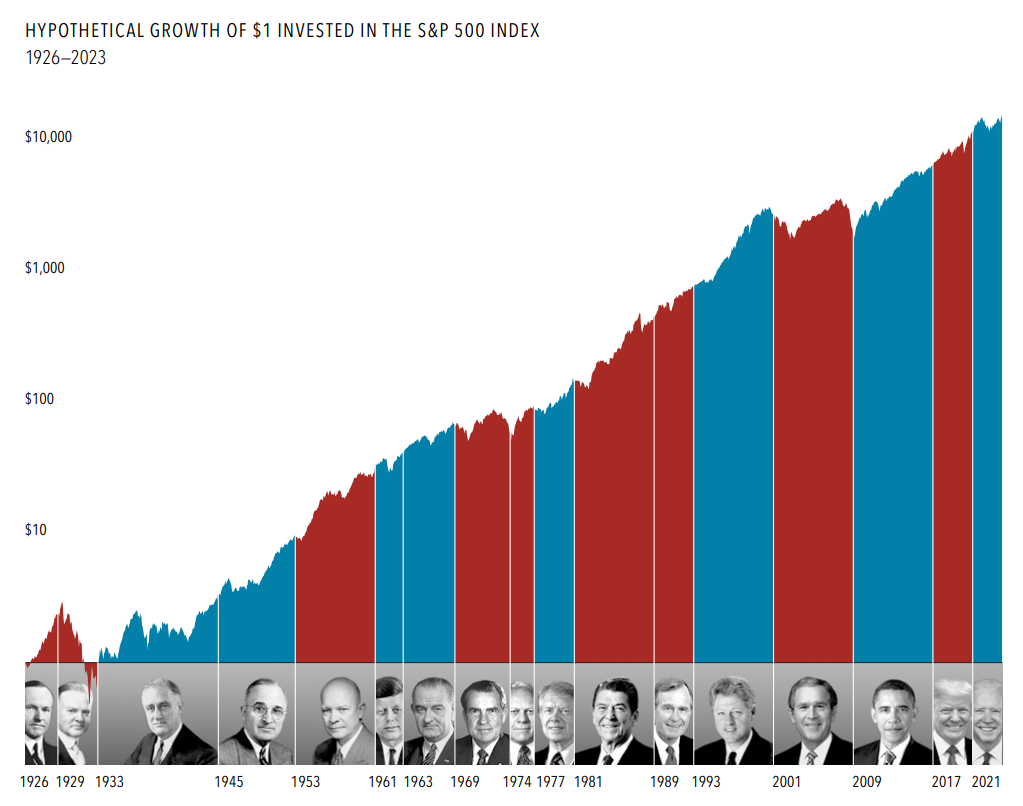

In fact, the stock market has often shown resilience, even thriving under different political administrations. What this tells us is that while policies may shift, the long-term trajectory of the market is generally upward. Businesses will continue to seek profits, entrepreneurs will innovate, and new opportunities will arise. The graph below shows the history of the stock market (S&P500) by presidential term. While there are little drops along the way, the overall trajectory is upward.

For long-term investors, the most important takeaway is that your portfolio is designed to withstand temporary ups and downs. By maintaining a diversified investment strategy and avoiding knee-jerk reactions, you can stay on track toward your financial goals—regardless of who wins the election.

Why Diversification and Discipline Matter

One of the best ways to help protect your portfolio from election-related uncertainty—or any short-term market volatility—is through diversification. A well-diversified portfolio spreads investments across a wide range of sectors and asset classes, so if one area of the market is hit hard by a political or economic shift, others may remain stable or even thrive.

Businesses, too, are remarkably resilient. Regardless of who is in office, companies are motivated to adapt, innovate, and find ways to remain profitable. While certain policies may impact specific industries in the short term, the overall economy has shown a remarkable ability to adjust and grow over time.

This is why you should avoid the temptation to make big moves based on political predictions. Attempting to time the market or making decisions based on headlines can result in missing out on long-term gains. Successful investing is less about reacting to short-term noise and more about maintaining a steady focus on your financial goals.

Focus on What You Can Control

At the end of the day, no one can predict the future. We can’t control election outcomes, market reactions, or global events, but we can control how we respond. The most effective way to protect your portfolio during times of uncertainty is to stick to your long-term plan and avoid making emotional decisions based on fear.

If you’re feeling anxious about how the upcoming election might affect your investments, it might be a good time to review your financial plan with your HFM advisor. A well-crafted plan, focused on your individual goals and risk tolerance, will help make sure you’re prepared for whatever comes next.

The Bottom Line

While election years often bring uncertainty, they don’t have to bring chaos to your portfolio. Staying disciplined, maintaining a diversified strategy, and keeping a long-term perspective are the keys to weathering political and market changes. Remember, elections come and go, but your financial goals remain the priority.

Remember, we’re here to help you navigate with confidence. If you have concerns about how the election might impact your portfolio, don’t hesitate to reach out. We’re here to provide coaching, reassurance, and a steady hand to keep you on track.

—

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In USD. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 index. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

102 WEST HIGH STREET, SUITE 200

GLASSBORO, NJ 08028

HFM Investment Advisors, LLC is a registered investment adviser. All statements and opinions expressed are based upon information considered reliable although it should not be relied upon as such. Any statements or opinions are subject to change without notice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. All investments involve risk and are not guaranteed. Information expressed does not take into account your specific situation or objectives and is not intended as a recommendation appropriate for any individual. Listeners are encouraged to seek advice from a qualified tax, legal, or investment advisor to determine whether any information presented may be suitable for their specific situation. Past performance is not indicative of future performance.